Industrial market report Q3 2021

Industrial investment flows are now not only ahead of the same period in 2020 but also significantly ahead of 2019 levels, driven by the continued strength of investor interest in the logistics sector.

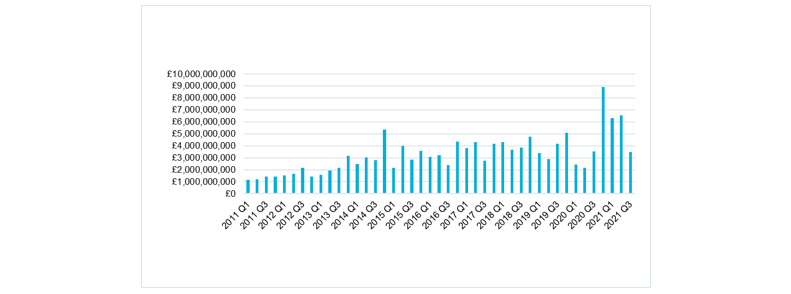

2021 has seen an increase in investment sales volumes against 2020 levels. Each quarter (to date) of 2021 has seen an average of £3.4 billion of investment transactions, compared with £2.3 billion a quarter average over the last five years.

Investment sales volume (£)

Source: Cluttons, CoStar

Industrial sector continues to attract significant inflow of capital

Investment volumes show how unusual the last year has been; with an average £3.4 billion a quarter of sales transactions. This compares with £2.3 billion a quarter average over the last five years. Whilst Q3 2021 currently looks a little lower than the last few quarters this could still be revised upwards as more deals agreed late in the quarter get added to the total. In this context, yields continue to trend lower; from 4.5% a year ago, the average UK industrial yield is now 4.0%. With such strength of demand focused on the South East, there is a significant margin between industrial yields; 3.4% in the South East and 5.0% average for the rest of the UK.

Industrial yields (%)

Source: Cluttons, MSCI

Low vacancy rates continue to drive rents higher

With vacancy rates persistently below 4% since mid-2016, market momentum continues to drive rents higher. Rental growth is running strong at 6.2% per annum average across UK industrial. A key factor of this strength is online retail and logistics demand. With the complexities of an efficient distribution network, new demand is likely to be ongoing as companies seek to optimise for efficiencies in their distribution network.

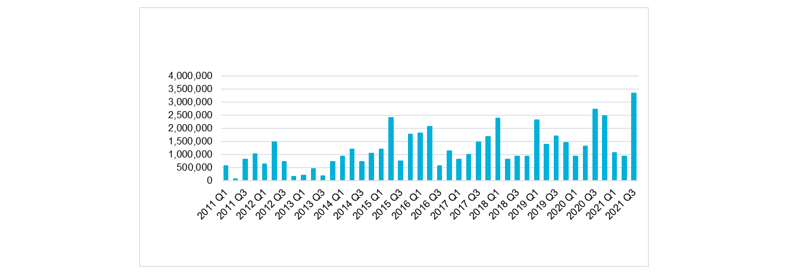

Construction completions adding to available space

As previously acknowledged, there has been an upswing in the development cycle. Some of this space is now completed and on the market with the largest quarterly delivery of new space in over 10 years for the South East (3.3m sq ft). Low vacancy rates are indicative of the strength of demand ready to absorb new completions: at average demand levels (measured by net absorption) over the last five years that represents just nine months of demand.

South East industrial new supply (completions sq ft)

Source: Cluttons, CoStar

Manufacturing conditions remain stronger than 2019

Latest readings of the IHS Markit/CIPS UK manufacturing PMI signals a strong pace of expansion in the manufacturing sector, albeit at a marginally lower level than the high achieved in May 2021. The survey is indicative of the strong bounce back in the sector with levels running higher than pre-pandemic. As with other sectors of the economy, production will be affected by supply chain issues (access to materials, staff and skilled labour).

Outlook

As the economy recovers from the pandemic, there will be upward and downward swings in sentiment. There was a strong lift to mid-year and since then a few indicators have slipped sideways, largely the result of supply chain issues, emerging inflation and expected interest rate rises.

Alongside the bounce back in the economy, real estate markets are coming back to life but at different speeds and with different ferocity. Throughout the last few years, the industrial sector has hardly missed a beat; total returns for this sector over the last 12 months are 28.6% for standard industrial and 32.1% for distribution warehouses. Investment volumes in the sector have been particularly strong with year to date investment flows for the sector significantly ahead of 2019 levels (£5.6 billion in 2019 v £8.8 billion in 2021). This sector will continue to evolve with the changing face of retail and the ongoing drive to exact every last ounce of efficiency out of corporate distribution networks.

Commercial market report Q3 2021

- Office market report Q3 2021

- Industrial market report Q3 2021

- Retail market report Q3 2021