Office market report Q3 2021

There are emerging signs of polarisation in the office market between top spec buildings versus those of a lower quality.

The post pandemic bounce in leasing activity has been driven in particular by demand for higher spec buildings which has meant that headline rents have been maintained, albeit by pushing out incentives.

New hybrid work model will be a slow evolution

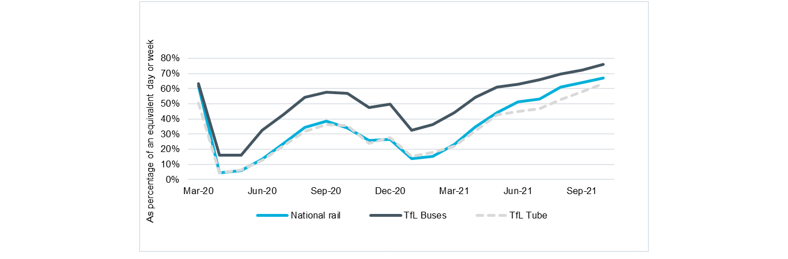

September and beyond was always likely to be a useful litmus test for the number of employees physically returning to the office. And indeed, public transport data shows that TfL tube usage by the end of October was back to 63% of its pre-pandemic level, TfL buses back to 76% and National Rail back to 67%. Transport usage might plateau at these sorts of rates: given a rough assumption that a third of London’s workforce can’t work from home and that the remaining two thirds now work from home two days a week this would equate to a new normal of 73% usage compared to pre-pandemic levels. The new hybrid work model is likely to be a slow evolution with decisions on office space usage undertaken at lease renewal.

Public transport usage

Source: Cluttons using Gov.uk official stats.

New demand focused on better building quality

Given the pandemic uncertainty it is no surprise that office occupational trends have been weaker, demand levels remain down. In Q3 the tentative pickup in take-up gained some momentum in Central London but is yet to translate into a significant bounce. For regional office markets, the pickup has been less significant with strongest evidence of a rebound in Birmingham.

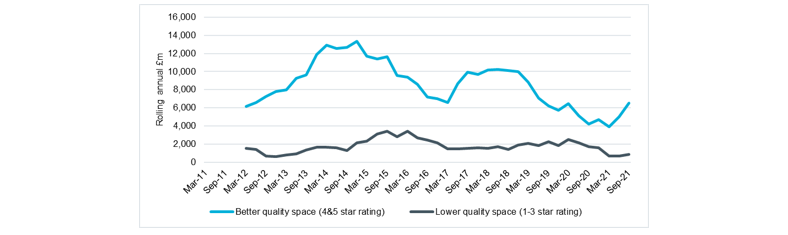

There is an increasingly apparent split in the market between leasing activity for prime buildings and leasing activity for lower quality secondary buildings. This makes sense in a pandemic environment where companies are looking to enhance the office-based experience for employees. This split is only showing tentatively in the data as yet, and is best represented by monthly data, but certainly allies trends observed by Cluttons in the market. For landlords with lower quality buildings there is a strategic decision to be made about whether to invest and upgrade their buildings.

Central London leasing demand: by building star rating

Source: Cluttons, Costar

Rising vacancy rates

Even with large parts of the office work force returning to their place of work more regularly since September there is still evidence in the market that companies are making decisions to shed space. Alongside, weaker demand data vacancy rates are above their levels a year ago for both Central London (current 8.0% versus 5.9% a year ago) and key regional office markets alike (current 5.9% versus 4.7%). This rise in vacancy rates is likely to be focused on poorer quality space.

Strong investment inflows

The current market is unusual that despite overall vacancy rates rising, investment flows over the last quarter have been stronger than the five-year average. For the London office market, there was £2.4 billion of investment deals compared to a quarterly average of £2.2 billion over the last five years. Strong international interest in City and West End offices has seen yields compress by -0.25% for best in class. As such there is a flight to best in class and secondary assets are not benefiting from the same strength of investor interest.

Central London office: investment volumes

Rolling annual £ million

Source: Cluttons, CoStar

Outlook

There are varying degrees of recovery across office markets with an occupational and investor flight to quality apparent. For top spec buildings in Central London the bounce back in take-up and investor volumes has been stronger. The highest quality space has been able to maintain headline rents, albeit by pushing out incentives. Secondary space, particularly that without any real placemaking attributes, rents are under a lot more pressure. Across occupational and investor markets, ESG credentials are also becoming a more important component.

‘Hybrid working’ will be a dominant catch phrase for a while yet as a slow evolution of the way occupiers seek to use their office space unfolds. Covid numbers through the winter remain critical for how many workers regularly work from the office for the next few months versus those that predominantly work from home. Flexibility remains the key element to the outlook.

As with the economy, we should expect upward and downward shifts in activity and sentiment towards both occupational and investment real estate markets, but the overall trend will continue to be one based on stronger fundamentals.

Commercial market report Q3 2021

- Office market report Q3 2021

- Industrial market report Q3 2021

- Retail market report Q3 2021