Forecasts & outlook Q4 2020

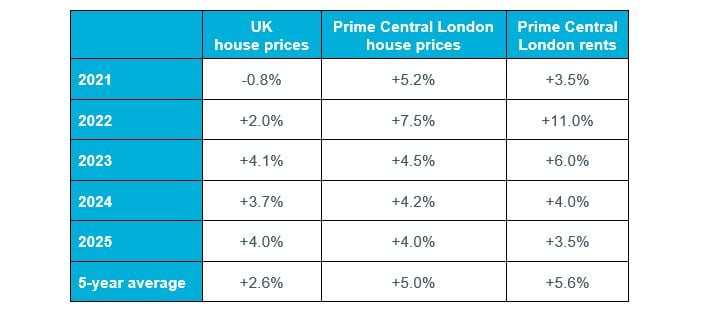

The table below shows Experian’s latest house price forecasts for Cluttons, all based on their latest central economic scenario of GDP returning to end-2019 levels in early 2023 – this is a slower recovery than expected last quarter.

Table 1: Experian House Price Forecasts, February 2021

Source: Experian

At national level, Experian expect small house price falls in 2021, driven by a combination of the end of the stamp duty holiday, the end of Government income support schemes, and a rise in unemployment. This is followed by a small rise in 2022, then stronger growth in 2023 to 25 as the economy recovers more fully. The short-term outlook is sensitive to changes in the pandemic and any policy responses, in particular due to further virus variants, the success or otherwise of the vaccination programmes, and extensions to the economic support packages.

By contrast, Experian consider that PCL capital values and rents will both return to strong growth more quickly after bottoming out in Q1 2021. They forecast five years of rises for both sales and rental markets, although the highest increases are now expected in 2022, with continuing lockdowns and travel restrictions in the early part of this year dampening the scale of bounce back previously expected.

Other Forecasters

The HM Treasury comparison reports collect economic forecasts on a range of subjects, including house prices. A sample of UK house price forecasts from the January report are shown in Figure 1, compared against their equivalents from October and July. The chart shows that, while there have been large revisions over the past six months, in general these have been negative changes and the economists in this sample are moving towards a consensus of small price falls in 2021. The median of all new forecasts in the report was -2.8% in January, compared to +3.0% in July 2020.

Figure 1: 2021 UK House Price Forecast Comparison

Source: HM Treasury (Month is date forecast made)

A selection of the latest forecasts from other property consultancies are shown in the table below, along with the central scenario from the OBR. While the shape of the different forecasts varies, there is agreement that annual growth of around 3% is expected over the next five years.

Table 2: UK House Price Forecasts

Source: Forecasters’ websites and publications. *OBR central scenario. ^At time of publication Savills have not yet released forecasts for 2021 to 25.

Risks and Opportunities

The potential range of outcomes for the housing market in 2021 is very wide. Many new drivers and trends emerged in 2020 and it is not clear how long they will persist or how significant their impact will be going forward.

At the national level, we know that there is still a backlog of agreed sales that need to complete, and that buyers will be keen to do this before April to save on stamp duty. Q1 is likely to see similar behaviour to the second half of 2020, with high transactions and values continuing to be supported.

From Q2 the underlying demand in the market will be tested. The success of the early stages of vaccine roll-out have raised hopes that life will be more ‘normal’ by the summer, with this boost to confidence potentially keeping the market going and avoiding a post-SDLT holiday slump.

However, there are clear downside risks. Government financial support will start to taper off, revealing the full extent of the damage to the economy. If consumers and lenders respond with caution, transactions and values are likely to fall back.