Retail market report Q2 2021

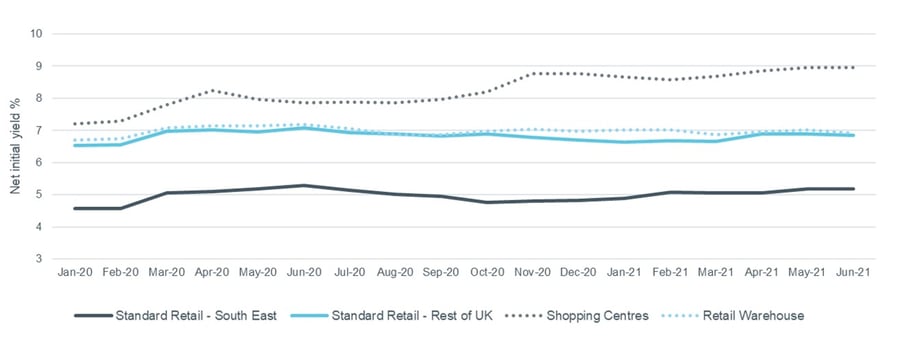

Retail yields have repriced as average UK retail yields are now 6.8% which compares with 5.3% five years ago.

With a potential strong post pandemic recovery story for some affluent towns, there is a case to reassess the outlook for some of the more resilient parts of the retail landscape.

Consumer confidence has soared

The lifting of restrictions over the last few months has clearly helped put a spring in the consumer’s step. The PWC Consumer sentiment survey recorded its highest score since the series began (2008) whilst the GfK Consumer Confidence index July result is already the highest since March 2020 as the opening economy shows signs of strengthening.

These stronger signals are positive for the retail sector, as many households have accrued savings through the downturn and appear ready to start spending again. The Bank of England believes that households have accrued £150bn in savings through the course of the pandemic. These savings are concentrated in affluent neighbourhoods particularly across London and the South East and it is in these areas that a big spending injection will help drive a speedier economic recovery.

What proportion of retail sales can shops regain?

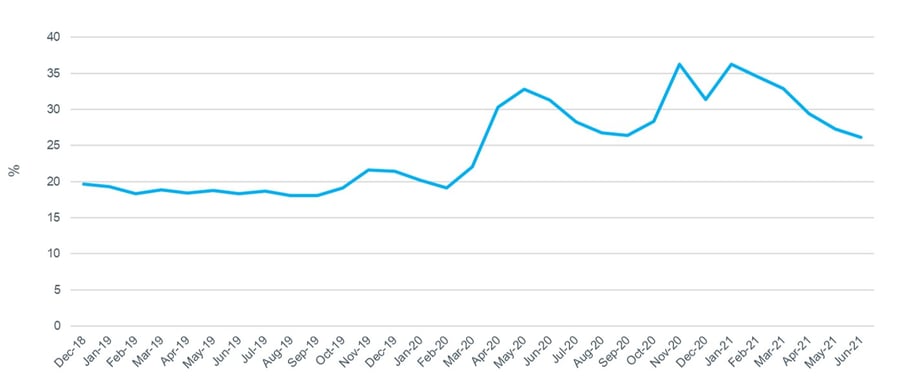

Key for physical retail assets is how much sales they can win back from online. Online retail sales grew to a record proportion of 36% of total sales in late 2020/early 2021 but as retail has re-opened this has fallen back to 27%.

Secondary retail a potential focus for new permitted development rights

From 1 August new permitted development rights came into effect. The key change relevant to the retail sector is an expansion of rights under the new use class ‘MA’ to include the whole of ‘E’ use class (shops, office, restaurants, cafes, health services, nurseries, gyms and leisure). Changes to these rights could affect secondary retail more significantly, for instance off-prime pitches in quieter streets could make for better conversion to residential potential particularly also given the upper size limit of 1,500 sq m (16,146 sq ft).

Repricing tempting some investors to look again

In performance terms, shopping centres have been the hardest hit by the pandemic owing to the seismic shift in shopping habits, but few corners of the market have escaped completely unharmed. Across all sectors of the retail sector rents are falling and void rates have been rising. The uncertain outlook for the sector, already reflected in falling rent levels, has impacted on yield levels albeit modestly for most segments of the market.

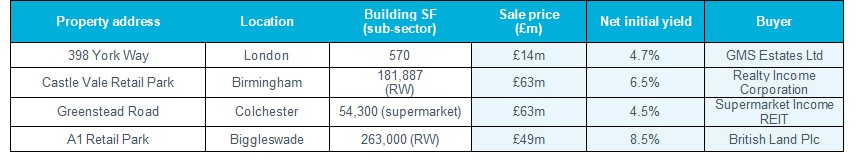

This repricing of assets has led to some investors reassessing the market, in a more positive light particularly resilient high street locations with the focus on strong covenants such as banks and “Covid-resilient” businesses such as pharmacies (e.g. Boots).

Retail returns improved for the second consecutive quarter

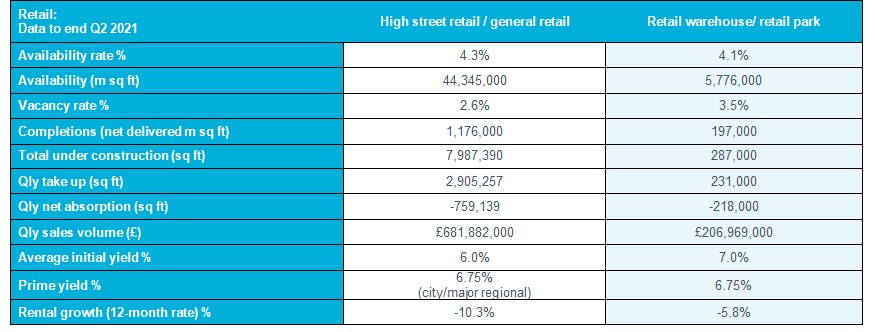

Returns were 2.5% in Q2 driven by a strong recovery in retail warehouses (4.4% over the quarter). Retail capital values did rise 0.7% in Q2 driven by retail warehouse performance (2.5%); declines were evident in all the other segments of the retail market with shopping centres the most impacted at -2.7%. Initial yields have also nudged lower over the last month to end June.

Outlook

The shift in sentiment from the start of the year to the middle of the year has been dramatic. At the start of the year, many parts of the economy were in lockdown and the vaccine rollout had only just begun. Fast forward to mid-year and sentiment and optimism is significantly stronger across a range of Covid and economic related measures. This is matched by stronger market conditions for the real estate sector (both investment and occupier markets) which is expected to continue; particularly given the continued easing of restrictions and the strong bounce back in the UK economy.

Retail assets have borne the brunt of the downturn, but more stability across the sector is likely to emerge over the rest of this year. There are also potential opportunities for investors to benefit from the unwinding of ‘Covid savings’ with local high streets in affluent towns likely to be chief beneficiaries. There has also been a strong improvement in the prospects for retail warehouses, driven by the servicing of click and collect orders and redevelopment potential (either to increase density or repurpose for numerous alternative uses, including last mile logistics and/or residential accommodation).

Analysis

Internet sales as proportion of total retail sales retail

Source: Cluttons and ONS

UK retail yields

Source: Cluttons and MSCI.

Key statistics Q2 2021

Source: Cluttons, CoStar, Property Data and MSCI.

Key investment transactions Q2 2021

Source: Cluttons, CoStar and Propertydata.

Commercial market report Q2 2021

- Office market report Q2 2021

- Industrial market report Q2 2021

- Retail market report Q2 2021