London sales & rental review Q1 2022

Source: RICS Housing Market Survey (Mar 2022)

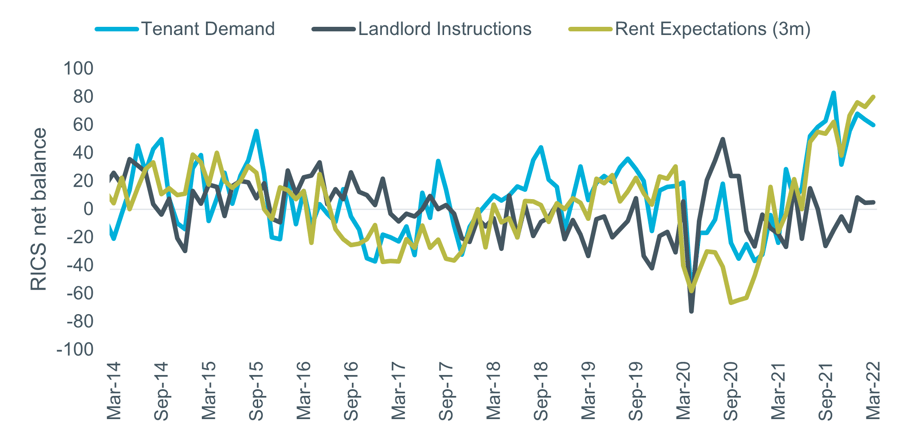

The dynamic of supply well ahead of demand in the London rental market also continued in Q1. The net balance for tenant demand increased to +60 in March, although new instructions did edge into positive territory at +5. Rent expectations hit another record high of +80.

Figure 3 – RICS Survey Rental Indicators, London

Source: RICS Housing Market Survey (Mar 2022)

Prime Central London

Sales values were unchanged in Q1 with a slight increase in rents, according to the Cluttons Prime Central London Index, the recent results of which are shown in Figure 4. On an annual basis sales values are broadly unchanged at 0.2% higher than Q1 2021. Rents have been relatively stable for three quarters but are up 17.2% compared to a year earlier.

Figure 4 – Cluttons Prime Central London Index