Forecasts & outlook Q1 2022

UK house price growth of 2.2% is forecast for 2022 by Experian, a slight increase compared to last quarter’s figures in nominal terms. However, with the inflation outlook looking much higher at 8.3% for the full year, this would be a significant fall in values in real terms. Over the remainder of the five-year horizon, the forecast is unchanged. Overall, in the five years to 2026, house price growth of around 18% is expected, compared to inflation of 20%.

Experian noted that the labour market outturn over recent months was relatively downbeat. Unemployment edged down further to 3.8% and the number of payrolled employees reached a record in March. However, the economic inactivity rate increased and unemployment is expected to rise again, back to 4.6% in the second half of 2022.

The overall five-year view for Central London sales values and rents are broadly similar to the UK picture, but in the shorter-term Experian expect stronger growth in London, noting that demand from domestic and overseas buyers remain attracted to prime London property as an investment. On the sales side this results in a forecast for values to rise by 6.2% in 2022.

The rental market has seen a lot of growth as city workers returned to their offices and the 2020 price falls were reversed. There is likely to be further room for growth in rents as these trends continue, with expectations of a 6.0% rise in 2022.

Other forecasters

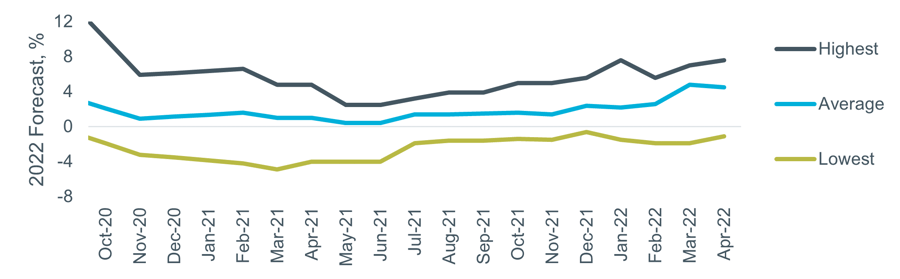

The HM Treasury comparison reports collect economic forecasts on a range of subjects, including house prices. The range of forecasts for 2022 house prices submitted over the past 18 months is shown in Figure 1. The spread of views has remained very similar to three months ago, and is quite large, indicating continuing uncertainty. However, the median new forecast has risen slightly over the past two months, reflecting the strong performance seen so far this year.

Figure 1 – 2022 UK house price forecast trend

Source: HM Treasury (Month = date of report, data is the range of forecasts made in last three months).

There is more of a consensus on 2022 forecasts among the other property consultancies, all expecting price growth in the 3.5 to 5% range. The five-year view is for relatively low growth, particularly in light of the inflation expectations over the period. The OBR’s central scenario was updated in April but remains broadly in line with the consultancies’ figures.

Table 2 – UK House Price Forecasts

Market Outlook

House price growth in double-digits when household finances are struggling does not add up to a sustainable economic situation. Many forecasters are expecting the cost-of-living squeeze to get worse before it gets better, driven by further increases in food and energy prices and a so far limited appetite for Government policies to mitigate any damage.

Rising mortgage rates and a reduction in consumer spending power could quite suddenly result in transactions slowing and prices stagnating or falling. The extent of these falls will be determined by the numbers of existing owners who have to sell into a weakening market. During the 2008 financial crisis, forced sellers were kept relatively low as lenders showed forbearance, and on the new build side market sale homes were switched into the affordable sector. While prices did fall significantly it could have been worse and values recovered relatively quickly, particularly in London and the wider South East.

Now there are more measures in place to check buyers can afford their mortgages and a larger majority are on longer fixed-rate deals. Combined with the significant number of outright owners the proportion of households able to wait out any downturn is relatively high, reducing the risk of a major price correction.