Commercial market update Q4 2021

It has been a long pandemic, and Omicron provided a sharp reminder that it might not be over quite yet. Despite this, there are signs of recovery in all sectors.

Industrial continues to lead on most indicators and retail, the most directly impacted sector, also shows signs of getting back on its feet with renewed investor interest. Several large office deals secured in the final quarter of 2021 have placed confidence in the London outlook.

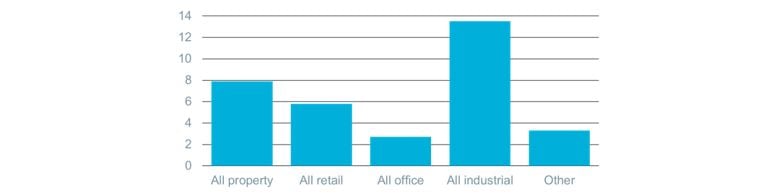

Total returns highest since early 2010

There was a very strong end of 2021, even in the context of a typical Q4 spike. Across the board total returns were positive in the final quarter including for high street retail and offices. Industrial performance was exceptional, with retail warehouses the best performing retail component (8.7%).

Figure 1. 3-month total return at Q4 2021, %

Source: MSCI

Unprecedented yield compression

MSCI data showed significant yield compression over the final quarter of 2021, net initial yields moved from 4.7% in September to 4.4% by end of December. Such yield compression is unprecedented. Yields are expected to continue to tighten this year with the economic recovery boosting rental growth potential further. Rising interest rates will have an impact as swap rates rise but this is likely to be moderate given that interest rates are predicted to remain low.

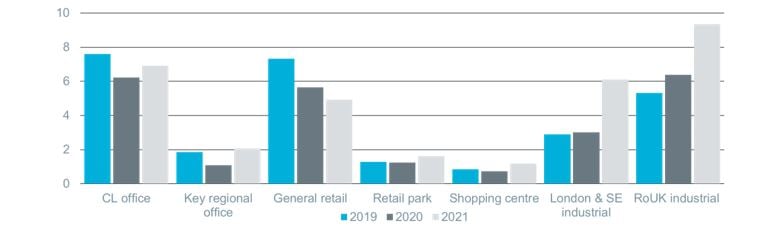

Investment volumes appear to be holding up

Investment sales volumes have held up, in some sectors remarkably so: over the course of 2021 £6.1bn had been invested in industrial across London and the South East and another £9.3bn across the rest of the UK. It is, however, notable that, across sectors, whilst the investment value was high the number of deals was thinner, reflecting a shortage of investment grade stock.

Figure 2. Investment sales volume, £bn

Source: Cluttons analysis of Costar data

Big Box land consumption

While much of the attention through covid lockdowns has been worrying about the future of the office, another sector, big boxes, has proliferated to such an extent that some local authorities have seen 10 years supply of employment land consumed in half that time. Along the arterial roads from ports there is huge demand for very large distribution centres; one example being Belgian company Weert’s first UK operation; an 800,000 sq ft shed in Bury St Edmunds. Pressure for strategic-scale sheds seems unlikely to retreat in the immediate future and upward pressure on demand has contributed to annual industrial rental growth hitting a new record of 7.2% as yields continue to harden. Read more on industrial here.

Small sheds matter too

One sector that has, unarguably, benefitted from the pandemic is online retail. This is one element that has driven the strong performance of industrial property, and an emerging trend of urban / last mile logistics. While there will undoubtedly be consolidation as the pandemic eases it is inescapable that many consumers have got used to very efficient delivery promises. The availability of local light industrial units is important to support this.

The new E category use class, compounded by the weakening of Article 4 Direction powers, was intended to ease the path for converting redundant commercial space to housing via Permitted Development Rights. But a less positive side-effect appears to be downward pressure on the availability of light industrial space, particularly in smaller towns.

On the flipside, the changes have given local authorities the chance to repurpose tired local buildings, for example by letting small offices and maker spaces to breathe life into struggling shopping centres.

The hybrid office debate resolved

This year is likely to resolve the hybrid office debate as occupiers road test and develop new occupational strategies. The amount of ‘me’ space allocated per worker is likely to be reduced in favour of amenity and collaboration ‘we’ space. The final outcome of the new hybrid working model remains unclear for now but what is clear – and will be a persistent trend – is the two-tier market between prime grade A and secondary space. This flight to quality is driven not just by occupiers seeking improved space, but by the ESG agenda and a recognition of the costs involved in becoming more energy efficient. Read more on the office market here.

Retail becomes attractive

Given the significant rebase in rents and values, the retail sector is attracting investor interest once more. Two large shopping centre deals in the final quarter of 2021 stand as testimony to the start of renewed confidence in the sector: Henderson Park’s acquisition of Silverburn, Glasgow for £140m and LCP Group’s purchase of Cwmbran Shopping Centre in South Wales for £145m.

The fall in rents has been dramatic in places but by the end of 2021 that rental decline had largely found a stable floor. There are headwinds for the consumer (cost-of-living squeeze) but with large covid household savings yet to be fully unwound, there is still an expectation that consumer spending will be strong. Read more on the retail market here.

Investors chase prime assets

Weight of money will continue to chase prime assets through this year and with limited ability to recycle capital back into the market, many investors will hold onto assets rather than realise profits. The industrial sector is likely to be a chief beneficiary of investment interest but alternative assets such as residential are also likely to be high on investors’ strategic ambitions.

Commercial market update Q4 2021

Read our reports: