Forecasts & outlook Q2 2021

UK house price growth is expected to continue, but at a slower pace after a very strong start to the year. The momentum built up is such that falls are not anticipated, even as Government employment support schemes are withdrawn.

Central London will see a strong recovery, starting next year for the sales market and this year for lettings.

House price forecasts

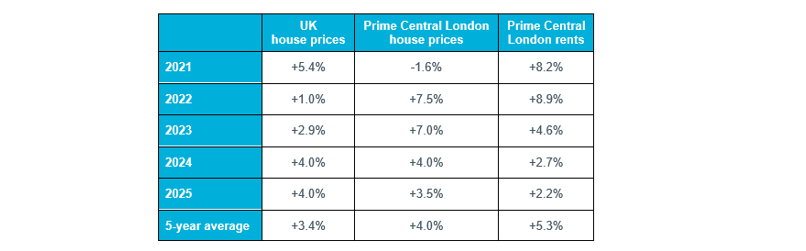

Experian’s latest house price forecasts for Cluttons are shown in the table below. This is based on a baseline* economic scenario that sees GDP grow by 7.7% this year and 6.2% in 2022.

Table 1 – Experian house price forecasts, July 2021

Source: Experian. * Baseline economic scenario assumes that Coronavirus Delta variant is contained, with no further lockdowns in 2021.

Experian expect UK house prices to finish 2021 up by 5.4%. While this is a strong revision upwards from last quarter’s forecast, taking into account the performance seen in the first half of the year, it is below the current rate. A slowdown is likely due to Government employment and housing support schemes ending in Q3. This will be followed by slow growth for two years before house price inflation picks up again in 2024 and 25.

Central London’s market has behaved very differently through the pandemic, with large falls in rental and capital values in 2020 that are now bottoming out. Experian anticipate that the sales market will see further small falls in 2021, followed by a strong bounce back over the next two years as key components of the London economy – offices, retail, leisure and hospitality – reopen more fully. Rents are already showing signs of returning to growth so the forecast expects a strong recovery this year, more of the same in 2022, and another above-inflation rise in 2023. However, pre-pandemic levels would only be reached in mid-2023 given the scale of falls already seen.

Note that the short-term outlook is sensitive to changes in the pandemic and any policy responses, in particular due to further virus variants, the success or otherwise of the vaccination programmes, and extensions to the economic support packages.

Other forecasters

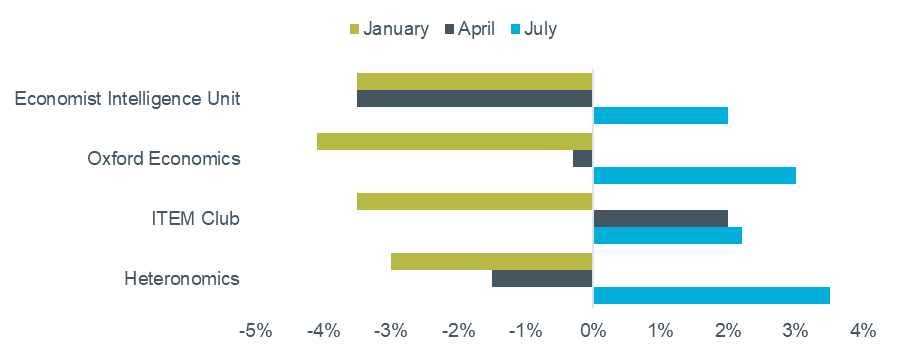

The HM Treasury comparison reports collect economic forecasts on a range of subjects, including house prices. A sample of UK house price forecasts from the July report are shown in Figure 1, compared against their equivalents from April and January.

Figure 1 – 2021 UK house price forecast comparison

Source: HM Treasury (Month is date forecast made)

The performance of house prices over the first half of 2021 has led the forecasters to adjust their figures upwards in the latest results. The median of all new forecasts in the report was +3.5% in July, compared to +1.6% in April.

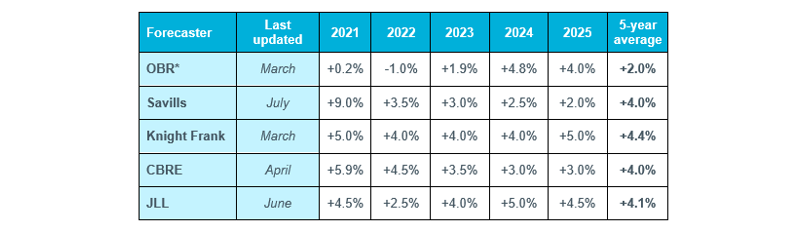

A selection of the latest forecasts from other property consultancies are shown in the table below, along with the central scenario from the OBR. The consultancies all agree on average annual rises of around 4% over the five-year period, but Savills’ latest figures have been revised to bring forward more of the growth to this year.

Table 2 – UK house price forecasts

Source: Forecasters’ websites and publications. *OBR central scenario

Risks and opportunities

The ‘b’ word – bubble, not Brexit – was mentioned last quarter as a potential risk as house price growth accelerated despite the pandemic continuing to impact the economy. However, with much of the increased market activity driven by equity-rich and higher-earning home movers, and mortgage rates remaining low, values are approximately where models would predict based on the underlying financial metrics. Analysis by the Bank of England, in their July Financial Stability Report, broadly agreed with this, noting that there was limited growth in riskier mortgage lending, with debt-servicing ratios remaining low.

On the pandemic, the UK’s vaccination programme appears to have reduced the link between Covid infection numbers and hospitalisation and death rates. The final step in unlocking the domestic economy was delayed by a month but took place on July 19th, although some guidance is still in place in practice. This change could bring both positive and negative consequences for the housing market and wider economy.

On the positive side, the return to some level of normality is clearly welcome and is likely to build consumer confidence across the economy, which is important for all housing markets but especially for any linked to returning face-to-face business sectors like employment, education and tourism.

There are also potential downsides to unlocking now while the virus is still circulating. These risks include allowing vaccine-resistant variants to develop, necessitating a return to lockdown, or other nations limiting travel to the UK if they do not have high levels of vaccination. Isolation rules continue to impact consumers and businesses, with some sectors seeing significant staff shortages.