Industrial market update Q1 2022

Clouds appearing for the logistics sector?

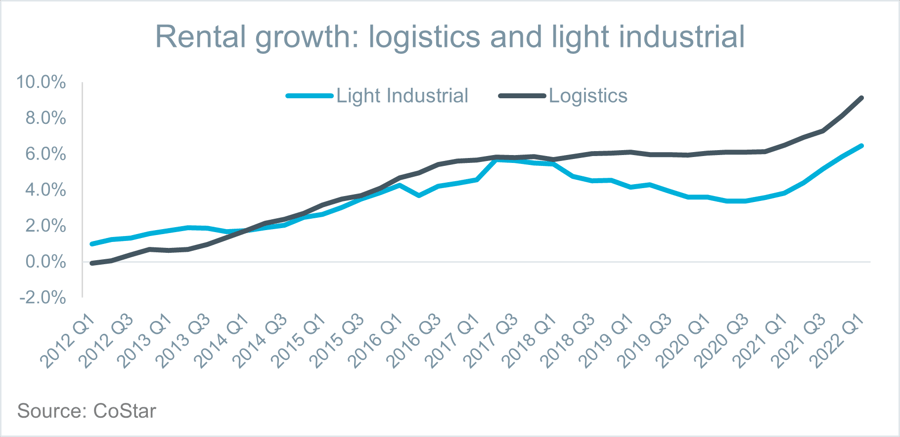

Overall, it is clear that industrial occupiers’ margins will be squeezed this year not just from high rents. Inflation driving higher business and operating costs, falling retail sales alongside supply chain constraints. This combination of factors makes it seem likely that rental growth prospects for the sector could dimmish over the course 2022 after an incredibly buoyant 2021. Without ongoing strengthening in rental growth prospects, it will be more difficult for investors to justify yields of around 3%. This could well just be a mid-cycle pause for the sector, with long-term structure of increasingly online and on demand retail in its favour.