Prime Central London’s global demand & local markets

Future Residential Series

Prime Central London attracts people from across the world, with demand for homes reflecting global political and economic trends. But local factors are also important. Each sub-market of Prime Central London has its own appeal to different people.

In recent years, domestic taxation has had a big impact on the market and could continue to do so in the future. This article looks at what makes Prime Central London so attractive, the trends in who lives there, and what impact that has had on London’s wider housing market.

Global City

Prime Central London has evolved over hundreds of years and the people who live, work, and buy homes in the area have also changed. The decline of the upper classes following the first world war, destruction of buildings during the second, and high rates of taxation in the decades after, led to homes being knocked down or turned into offices. More recently, Middle Eastern and US buyers were active in the 1980s and 90s. Oligarchs took over in the 2000s. The 21st century has seen Far Eastern buyers become much more active in the new build sector. These trends demonstrate that Prime Central London is subject to changes in global demand driven by politics and economics along with more domestic drivers such as taxation and policy decisions, but it continues to evolve to meet the needs of its residents and home owners.

There are multiple reasons why London is so attractive to property buyers from around the world. As a global city, it offers a wide selection of culture, entertainment, and heritage. It is an international centre of business with a working day that overlaps most other global cities. English is the main international business language. The robust legal framework makes it an attractive place to store and protect wealth.

Relatively low rates of taxation make it an attractive country in which to own property. Although stamp duty has been raised, the costs of holding high value property are much lower than rival global cities like New York, Paris, or San Francisco. Its success reinforces future demand and there is a well-established industry ready and willing to service the wants and needs of the global rich and elite. A survey by LonRes1 reported 75% of London agents felt that the number of people looking to leave the capital had peaked, and 67% thought London house prices would outperform the rest of the country over the next five years (1LonRes Agent Survey May 2021). For the global community, London will remain an attractive place to live, work and play.

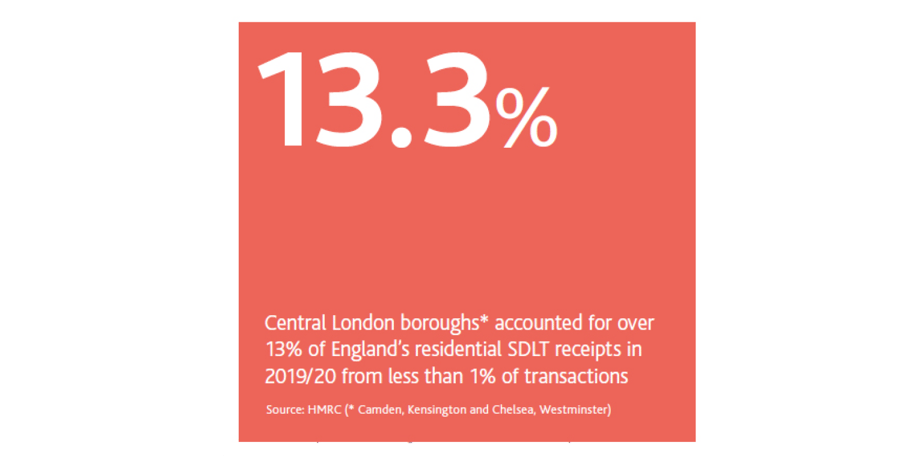

Turnover and taxation

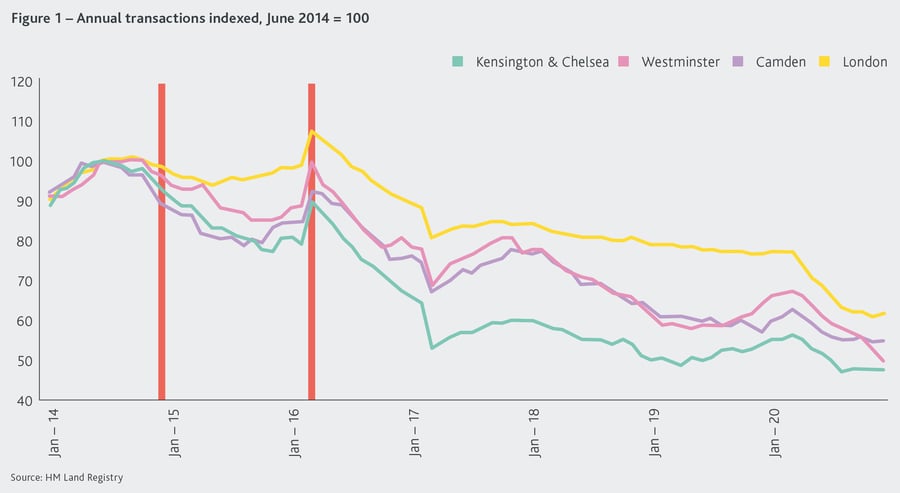

The Prime Central London housing market has been hard hit by changes to Stamp Duty Land Tax (SDLT) in recent years. In late 2014 there was the change from the “slab” approach, which applied a rate depending on the overall property value, to the current “slice” approach with increasing rates applying to the portion of the value above different price thresholds. This new “slice” approach led to much higher rates on properties valued over £1.1 million and contributed to a slowdown in the Prime Central London market.

In April 2016, a 3% surcharge rate was introduced for additional purchases – typically second homes and investment properties. This led to a short-term spike in activity in March 2016 as buyers rushed to beat the deadline, but then contributed to further declines in transaction numbers. This year has seen a further tax change that will affect Prime Central London with the introduction of the 2% surcharge for non-UK resident buyers. The impact of this latest change is unclear as it has coincided with the effects of the pandemic on overseas demand, but with so much wealth tied up in Prime Central London property it is clear that it will continue to be a target for raising additional tax receipts.

Local markets

There are some factors that affect the national housing market and there are others that affect Prime Central London as a whole. But there are some factors that only affect specific submarkets of Prime Central London. These factors might include local schools (including international schools), transport links to other parts of London, or historical preferences now reflected by the type of shops and restaurants found in the local area.

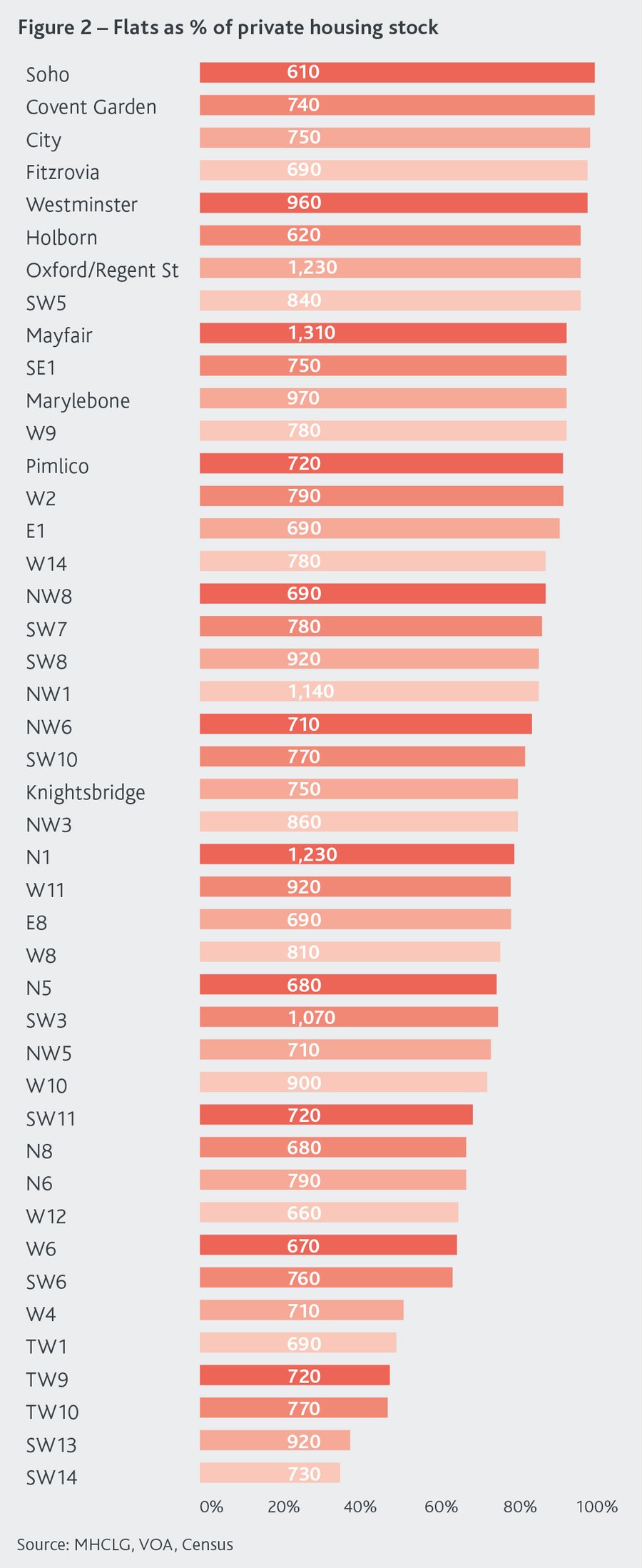

The housing stock in individual submarkets can also play a part. While transactions have fallen significantly across Prime Central London as a whole due to the stamp duty changes since 2014, our analysis shows a bigger fall in activity where there are higher proportions of flats in the local market. However, as always it is never this simple.

For example, both Mayfair and Earl’s Court have similar proportions of flats (c.90%) in their local housing stock. But transactions in 2019 were down nearly 50% in Earl’s Court and are relatively static in Mayfair, compared to 2014. A further clue to why this divergence has occurred can be seen by looking at the size of flats in the two markets.

The average size of flats sold in Mayfair is over 1300 sq ft while the average size of sold flats in Earl’s Court is only 850 sq ft. This reflects Mayfair’s position as an aspirational investment for the seriously rich and for whom stamp duty is an inconvenience, while Earl’s Court tends to attract investors looking to actively rent out their properties. They have been hit much harder by stamp duty changes.

Estate agent view: James Hyman, head of residential agency at Cluttons

“In times of uncertainty, the super-rich are drawn to core plus locations such as Mayfair where it is nigh on impossible for properties to lose value over the long term, and this cycle is no different. Markets with a greater share of domestic purchasers and buy to let landlords, including Earls Court, are more sensitive to affordability pressures. It is therefore inevitable that transaction levels there, particularly for smaller residences, have experienced sharper declines in recent years.

For some buyer groups, the decline in values for smaller apartments is a “silver lining”; demand for pied-à-terre properties has been relatively low since 2015/16, but 18 months of home-working, combined with reduced values for “1-2 beds” and studios could drive greater demand as we enter the recovery phase.

Moving further from Central Business Districts (CBDs) to afford more space is not a new phenomenon. Certainly, lockdown has taught the super-rich that access to green space is essential. For many, securing a centrally located home with access to a private garden offers the best of both worlds, gaining them private outside space, without losing the agglomeration benefits associated with the CBD.

London will, inevitably, remain popular and over the long term continue to expand. Victoria, previously an office destination, has in the past few years become an extension of super prime Belgravia. In recent decades the Southbank has evolved into a cultural centre which commands a premium for its riverfront properties. More recently, Kings Cross has evolved from an unloved part of London into a sought after destination for people to live, work and socialise. And looking ahead, the relocation of the US embassy to Battersea will continue to bring wealthy Americans further south, potentially creating a demand shift that will push pricing up to Prime Central London levels.”

The evolution of Prime Central London articles

To read the complete The evolution of Prime Central London report, follow the links below or use the Download the report button.

- The evolution of Prime Central London report

- What is Prime Central London?

- Prime Central London’s global demand & local markets

- What is the future of Prime Central London?